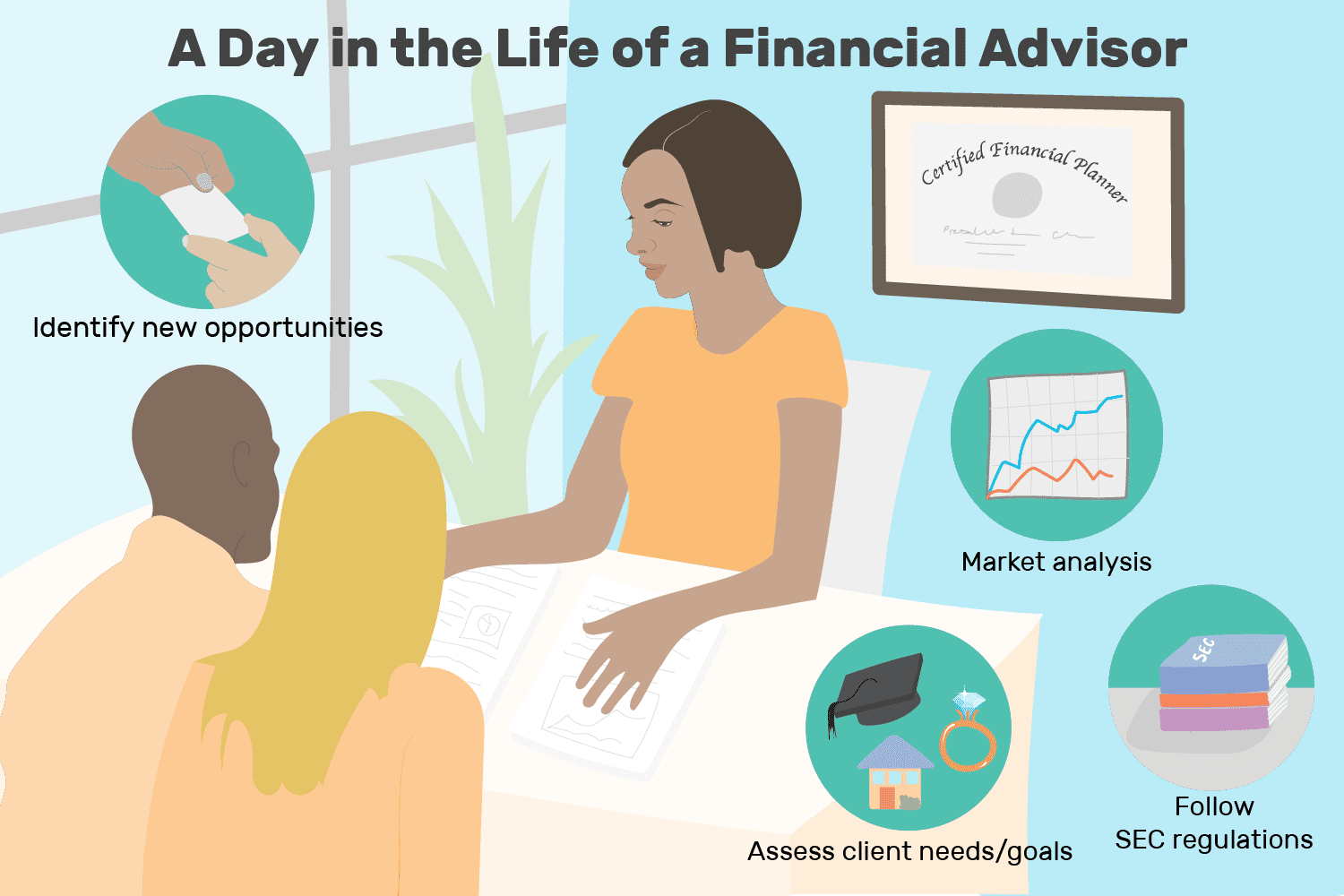

There are many options for financial advisors if you are interested. These include an internship and a bachelor’s degree. CFP certification is also possible. Once you have completed all these steps you can provide financial advice for clients. You must undergo specific training to become a financial advisor and register with a regulatory agency.

Earn a bachelor's degree

If you want a career as a financial advisor but lack the necessary experience, you can opt to earn a bachelor's degree in this field. This field is offered by many colleges, some of which even offer CFP-approved online programs. However, getting a job without experience is not an easy task, especially in the financial industry.

This field requires you to gain experience and establish relationships. You may be required to do an internship as part of your degree program. This will allow you to gain practical experience and earn credit. Moreover, you'll have the opportunity to charge higher rates once you're able to prove your abilities.

Completion of a Internship

To become a financial advisor you will need to have professional experience. Many graduate programs include internship requirements. These internships are a great way to experience the real world and determine if financial advice is right for you. To gain practical experience in the real world and to make connections, it is worth doing an internship even if your goal is to land a full time job right away.

Internships at firms and projects can be part your financial advisor career path. Interns are often hired by firms to help with business development. Interns are often able to help in the verification of beneficiary names and work on long-term health insurance projects.

CFP certification

CFP certification certifies that you have the knowledge and skills necessary to give financial advice. For anyone who wishes to work as a financial consultant, this credential will be required. This credential will allow you to communicate with clients, which is a crucial skill in this field.

There are many options for career choices in the field. One option is to start out as a front stage advisor. This will allow you to gain experience working at the front lines in a financial firm. For the next step in your career, which will be a senior planning role, you may need between three and seven years of experience. This job involves supervising subordinates and managing large accounts. Obtaining new business is also a major part of this role.

CFP certification

A CFP can be earned by working in a financial advisory firm, or through on-the-job training programs. As a financial advisor, you will need to sell yourself and network to land a job and the opportunity to earn the CFP designation. To get the support and guidance you need, you can join financial planning associations such as CFP Board.

The CFP designation is important because it shows that you have taken the time to study financial planning. This designation also indicates that you have experience and are qualified to work in the field of financial advice. Employers prefer candidates with this record. You can study part-time while you're working and earning your CFP.

FAQ

What age should I begin wealth management?

Wealth Management is best done when you are young enough for the rewards of your labor and not too young to be in touch with reality.

The sooner you begin investing, the more money you'll make over the course of your life.

You may also want to consider starting early if you plan to have children.

You may end up living off your savings for the rest or your entire life if you wait too late.

What is wealth management?

Wealth Management can be described as the management of money for individuals or families. It includes all aspects of financial planning, including investing, insurance, tax, estate planning, retirement planning and protection, liquidity, and risk management.

Who should use a Wealth Manager

Anyone who wants to build their wealth needs to understand the risks involved.

Investors who are not familiar with risk may not be able to understand it. Poor investment decisions could result in them losing their money.

This is true even for those who are already wealthy. Some may believe they have enough money that will last them a lifetime. But they might not realize that this isn’t always true. They could lose everything if their actions aren’t taken seriously.

Each person's personal circumstances should be considered when deciding whether to hire a wealth management company.

What is estate planning?

Estate Planning is the process that prepares for your death by creating an estate planning which includes documents such trusts, powers, wills, health care directives and more. The purpose of these documents is to ensure that you have control over your assets after you are gone.

Where to start your search for a wealth management service

If you are looking for a wealth management company, make sure it meets these criteria:

-

Reputation for excellence

-

Locally based

-

Consultations are free

-

Continued support

-

Is there a clear fee structure

-

Good reputation

-

It is simple to contact

-

We offer 24/7 customer service

-

Offers a wide range of products

-

Low fees

-

Hidden fees not charged

-

Doesn't require large upfront deposits

-

A clear plan for your finances

-

A transparent approach to managing your finances

-

This makes it easy to ask questions

-

You have a deep understanding of your current situation

-

Understand your goals and objectives

-

Are you open to working with you frequently?

-

Works within your budget

-

Have a solid understanding of the local marketplace

-

Is willing to provide advice on how to make changes to your portfolio

-

Are you willing to set realistic expectations?

What is a Financial Planner? How can they help with wealth management?

A financial advisor can help you to create a financial strategy. They can help you assess your financial situation, identify your weaknesses, and suggest ways that you can improve it.

Financial planners, who are qualified professionals, can help you to create a sound financial strategy. They can advise you on how much you need to save each month, which investments will give you the highest returns, and whether it makes sense to borrow against your home equity.

Financial planners are usually paid a fee based on the amount of advice they provide. However, planners may offer services free of charge to clients who meet certain criteria.

Is it worthwhile to use a wealth manager

A wealth management service will help you make smarter decisions about where to invest your money. You should also be able to get advice on which types of investments would work best for you. This will give you all the information that you need to make an educated decision.

However, there are many factors to consider before choosing to use a wealth manager. Consider whether you can trust the person or company that is offering this service. Are they able to react quickly when things go wrong Are they able to explain in plain English what they are doing?

Statistics

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

External Links

How To

How to invest after you retire

People retire with enough money to live comfortably and not work when they are done. However, how can they invest it? There are many options. For example, you could sell your house and use the profit to buy shares in companies that you think will increase in value. You could also purchase life insurance and pass it on to your children or grandchildren.

You can make your retirement money last longer by investing in property. Property prices tend to rise over time, so if you buy a home now, you might get a good return on your investment at some point in the future. You could also consider buying gold coins, if inflation concerns you. They do not lose value like other assets so are less likely to drop in value during times of economic uncertainty.