Ally Bank's Ally Invest brokerage branch offers low fees as well as a managed portfolio option. Ally Invest is able to provide research and screening tools, which are useful for novice investors. The website provides instant news updates from MT Newswire (Zacks Investment Research) and is accessible via the internet. Its pricing and options and stock fees are amongst the lowest in the industry.

Ally Invest is a brokerage division of Ally Bank

Ally Invest is a great option for intermediate and novice investors. It does not charge any fees for trades or advisory fees, unlike many brokerage firms. It makes its money from commissions. Ally Bank customers can apply for this branch. This brokerage charges low fees and has a broad portfolio. There is no minimum deposit. Customers of Ally Invest can also choose not to pay any management fees on the cash portion of their accounts. However, it is important to note that this cash does not receive FDIC insurance.

It offers a margin account

A margin account is a type of account that allows you to trade securities on a margin basis. The amount of money deposit is what limits how much money you may lose. Margin accounts can either be part of a general brokerage account or separate from it. No matter how you view it, it's important that you understand how margin accounts work.

It provides a managed portfolio option

Ally Invest portfolios are managed by a variety different types of investments. Some funds are stock funds while other funds are bond funds. The risk level for each portfolio will determine which option works best for the client. Clients can also access articles and calculators from the company to assist them in analyzing trades. Ally offers 24/7 live customer service. Ally's customer support representatives are available by phone, chat and the Ally mobile application, which is free to download from the App Store or Google Play.

It charges low fees

Ally Invest offers a great way to consolidate your financial affairs. Ally Invest's low fees make it easy for you to manage your investments. It is possible to make money transfers seamlessly between Ally account. A variety of technical tools are available to assist you in analyzing your assets. There are eight chart types available, as well as 117 unique charting indicators and 36 drawing tools. It also includes a lot of beginner-friendly tools.

It offers commission-free trades

Ally Invest is a popular option for investors looking to trade on a low-cost platform that does not charge commissions. Investors will love the many benefits of the company's platform, which includes no minimum balances or transaction fees. It is well-designed with many ways to contact customer service.

You will be charged a fee to obtain paper statements

Ally Invest charges a variety fees. $5 is charged per paper statement. A foreign transaction fee of 3% of the total dollar amount of the transaction is charged as well. A $25 fee can be charged to close an account. These fees should be considered when comparing different financial institutions.

FAQ

How to Choose an Investment Advisor

The process of selecting an investment advisor is the same as choosing a financial planner. You should consider two factors: fees and experience.

An advisor's level of experience refers to how long they have been in this industry.

Fees refer to the costs of the service. You should weigh these costs against the potential benefits.

It is crucial to find an advisor that understands your needs and can offer you a plan that works for you.

Who can help with my retirement planning

Retirement planning can be a huge financial problem for many. This is not only about saving money for yourself, but also making sure you have enough money to support your family through your entire life.

The key thing to remember when deciding how much to save is that there are different ways of calculating this amount depending on what stage of your life you're at.

For example, if you're married, then you'll need to take into account any joint savings as well as provide for your own personal spending requirements. If you're single, then you may want to think about how much you'd like to spend on yourself each month and use this figure to calculate how much you should put aside.

You can save money if you are currently employed and set up a monthly contribution to a pension plan. Another option is to invest in shares and other investments which can provide long-term gains.

You can learn more about these options by contacting a financial advisor or a wealth manager.

How to Beat the Inflation with Savings

Inflation is the rise in prices of goods and services due to increases in demand and decreases in supply. Since the Industrial Revolution, when people started saving money, inflation was a problem. The government manages inflation by increasing interest rates and printing more currency (inflation). You don't need to save money to beat inflation.

For example, you could invest in foreign countries where inflation isn’t as high. Another option is to invest in precious metals. Gold and silver are two examples of "real" investments because their prices increase even though the dollar goes down. Precious metals are also good for investors who are concerned about inflation.

How does Wealth Management work

Wealth Management is where you work with someone who will help you set goals and allocate resources to track your progress towards achieving them.

Wealth managers not only help you achieve your goals but also help plan for the future to avoid being caught off guard by unexpected events.

You can also avoid costly errors by using them.

Statistics

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

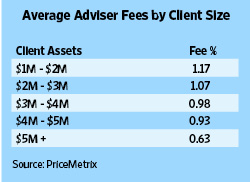

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

External Links

How To

How to beat inflation using investments

Inflation is one of the most important factors that influence your financial security. It has been observed that inflation is increasing steadily over the past few years. The rate at which inflation increases varies from country to country. India is currently experiencing an inflation rate that is much higher than China. This means that you may have some savings, but not enough to cover your future expenses. You may lose income opportunities if your investments are not made regularly. How do you deal with inflation?

Stocks investing is one way of beating inflation. Stocks are a great investment because they offer a high return of investment (ROI). These funds can also be used to buy real estate, gold, and silver. However, before investing in stocks there are certain things that you need to be aware of.

First of all, know what kind of stock market you want to enter. Do you prefer large-cap companies or small-cap ones? Next, decide which one you prefer. Next, you need to understand the nature and purpose of the stock exchange that you are entering. Are you looking at growth stocks or value stocks? Decide accordingly. Learn about the risks associated with each stock market. There are many stock options on today's stock markets. Some are risky while others can be trusted. Choose wisely.

Expert advice is essential if you plan to invest in the stock exchange. They will tell you whether you are making the right choice. You should diversify your portfolio if you intend to invest in the stock market. Diversifying your investments increases your chance of making a decent income. If you only invest one company, you could lose everything.

If you still need help, then you can always consult a financial advisor. These professionals can help you with the entire process of investing in stocks. They will ensure you make the right choice of stock to invest in. Furthermore, they will also advise you on when to exit the stock market, depending on your goals and objectives.