This article will explain how to get a Roth IRA. In this article, we will discuss how to get a Roth IRA and how to contribute to it. We will also talk about choosing investments and rebalancing the account. Make sure that you have enough money in your Roth IRA before you start.

Investing In A Roth Ira

The first step in investing in a Roth IRA involves deciding what kind of investments you want. Peer-to–peer lending platforms offer better returns than income investments, despite the fact that income investments are subject to risk and come with a lower rate of return. ETFs, passively managed investment funds, invest in an index. Although they have become extremely specialized over the years and are no longer viable for most people, they still offer a viable alternative.

Contributing to a roth ira

The first step in contributing to a Roth IRA is to determine whether you qualify for one. Earn money to be eligible for a Roth IRA. Earned income includes wages, salaries, and bonuses. It also includes tips or commissions. You are not eligible for income from investments and Social Security benefits. Unemployment compensation is not considered earned income. Roth IRA contributions are tax-deferred.

Making investments to fund a roth-ira

Before you choose investments for your Roth IRA, you should know exactly what kind of account you have. An investment broker can help you invest in individual securities and funds. A financial advisor can help you select investments. You can also use an automated investment service such as a robo-advisor, which will create an investment portfolio for you for a low annual fee. You don't need to make regular contributions in order to invest your money into a Roth IRA.

Balance a roth-ira

A good idea is to rebalance your Roth IRA if you have several investments. Diversifying your investment portfolio across asset classes is key to a good portfolio. This includes stocks, bonds and cash as well as precious metals. Diversifying within different asset classes is important. An example of this is a typical investor not wanting to own solely technology stocks in the United States. It would be safer for investors to hold a mixture of international and domestic stocks.

A robo advisor

Robo-advisors offer many benefits. A robo advisor offers you expert money management and doesn't require you to deal with the intricacies of investing. A robo-advisor cannot predict how your investments will perform, unlike human advisors. This article will explore some of these benefits when using a robo advisor to get a Roth Ira.

FAQ

What is risk management in investment management?

Risk management is the act of assessing and mitigating potential losses. It involves identifying, measuring, monitoring, and controlling risks.

Risk management is an integral part of any investment strategy. The goal of risk management is to minimize the chance of loss and maximize investment return.

These are the main elements of risk-management

-

Identifying risk sources

-

Measuring and monitoring the risk

-

How to control the risk

-

Manage your risk

How does Wealth Management work?

Wealth Management involves working with professionals who help you to set goals, allocate resources and track progress towards them.

In addition to helping you achieve your goals, wealth managers help you plan for the future, so you don't get caught by unexpected events.

You can also avoid costly errors by using them.

Is it worth hiring a wealth manager

Wealth management services should assist you in making better financial decisions about how to invest your money. It should also advise what types of investments are best for you. This will give you all the information that you need to make an educated decision.

There are many things to take into consideration before you hire a wealth manager. Do you feel comfortable with the company or person offering the service? Will they be able to act quickly when things go wrong? Can they communicate clearly what they're doing?

How old can I start wealth management

The best time to start Wealth Management is when you are young enough to enjoy the fruits of your labor but not too young to have lost touch with reality.

You will make more money if you start investing sooner than you think.

You may also want to consider starting early if you plan to have children.

If you wait until later in life, you may find yourself living off savings for the rest of your life.

Statistics

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

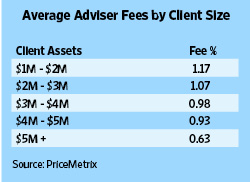

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

- These rates generally reside somewhere around 1% of AUM annually, though rates usually drop as you invest more with the firm. (yahoo.com)

External Links

How To

How to Beat Inflation with Investments

Inflation is one important factor that affects your financial security. It has been evident that inflation has been rising steadily in the past few years. The rate at which inflation increases varies from country to country. India is currently experiencing an inflation rate that is much higher than China. This means that your savings may not be enough to pay for your future needs. If you don't make regular investments, you could miss out on earning more income. How do you deal with inflation?

One way to beat inflation is to invest in stocks. Stocks can offer a high return on your investment (ROI). You can also use these funds to buy gold, silver, real estate, or any other asset that promises a better ROI. There are some things to consider before you decide to invest in stocks.

First of all, choose the stock market that you want to join. Do you prefer small-cap firms or large-cap corporations? Next, decide which one you prefer. Next, determine the nature or the market that you're entering. Are you interested in growth stocks? Or value stocks? Next, decide which type of stock market you are interested in. Finally, understand the risks associated with the type of stock market you choose. Stock markets offer many options today. Some are risky while others can be trusted. Take your time.

Get expert advice if you're planning on investing in the stock market. They will tell you whether you are making the right choice. Make sure to diversify your portfolio, especially if investing in the stock exchanges. Diversifying your investments increases your chance of making a decent income. You risk losing everything if only one company invests in your portfolio.

If you still need assistance, you can always consult with a financial adviser. These professionals can guide you through the process for investing in stocks. They will guide you in choosing the right stock to invest. Furthermore, they will also advise you on when to exit the stock market, depending on your goals and objectives.