It is difficult to know how many financial planners work in the United States. The number and type of financial planners in America will continue to grow over the coming years. Most are 55 or older. Financial planning cannot be retired from after you reach Medicare or Social Security eligibility. There are many reasons financial planners in America are needed, from the aging baby boomers to those looking for higher incomes.

218,100

There are many factors that go into ranking the best financial advisors. These factors include years of experience, the size of the firm and regulatory record. Credentials are also important. The list this year includes more than 218 million advisors. This is a sign of the importance of financial advisers in the economic landscape. The following are the Top 50 Financial Consultants in the USA.

Average salary

The average US salary for financial advisors varies from one state to the next. Financial advisors in high-paying state earn $169.310 annually, but those in lower-paying states only make half of that. The highest paying states include Massachusetts, Maine and Minnesota. Utah, Arizona and Tennessee are the states with the lowest salaries. In some states, financial advisors earn an average of $52,530.

States with the highest ratio of advisors to their population

According to SmartAsset reports, the US has a higher concentration of financial advisers in some states than other states. New York is the most populated state in America, with almost nine financial counselors per 10,000 residents. Connecticut is home of many hedge funds. The average Connecticut household has $18 million in net worth. Connecticut has a higher percentage of financial advisors per head than New York.

Regulations

Securities and Exchange Commission of the United States has increased regulatory requirements for advisors. This affects sales incentives and fees and securities recommendations. Many advisors consider regulators to be their enemies. In reality, however, the regulators are their partners and are working to make their jobs easier. These changes will have an impact on financial advisors who work in retail or retirement accounts. Read on to learn more about what this means for your firm.

Background checks

A background check can be done through any search engine. Simply enter the name of the financial advisor, along with its city and state, into a search engine. Search results can include legal judgments, birth records, and divorce records. Check for advisor-related articles. In addition, you should be aware of any landmines before engaging an advisor.

Regulation changes since 2007-2008

Recent financial crisis has highlighted the failures in major regulatory systems worldwide, which allowed financial firms to abuse the system and made the global housing downturn a disaster. A series of regulatory reforms may result in significant changes to the financial sector's functioning. But they should be designed in a way that addresses the problems that led to the crisis. Here are three examples. To address the root causes, regulatory reforms are needed.

FAQ

What Is A Financial Planner, And How Do They Help With Wealth Management?

A financial planner will help you develop a financial plan. They can help you assess your financial situation, identify your weaknesses, and suggest ways that you can improve it.

Financial planners are trained professionals who can help you develop a sound financial plan. They can help you determine how much to save each month and which investments will yield the best returns.

A fee is usually charged for financial planners based on the advice they give. However, some planners offer free services to clients who meet certain criteria.

What are the Benefits of a Financial Advisor?

Having a financial plan means you have a road map to follow. You won't have to guess what's coming next.

This gives you the peace of mind that you have a plan for dealing with any unexpected circumstances.

You can also manage your debt more effectively by creating a financial plan. Knowing your debts is key to understanding how much you owe. Also, knowing what you can pay back will make it easier for you to manage your finances.

Your financial plan will also help protect your assets from being taken away.

How can I get started in Wealth Management?

The first step towards getting started with Wealth Management is deciding what type of service you want. There are many types of Wealth Management services out there, but most people fall into one of three categories:

-

Investment Advisory Services- These professionals will help determine how much money and where to invest it. They can help you with asset allocation, portfolio building, and other investment strategies.

-

Financial Planning Services - A professional will work with your to create a complete financial plan that addresses your needs, goals, and objectives. A professional may recommend certain investments depending on their knowledge and experience.

-

Estate Planning Services: An experienced lawyer will advise you on the best way to protect your loved ones and yourself from any potential problems that may arise after you die.

-

Ensure they are registered with FINRA (Financial Industry Regulatory Authority) before you hire a professional. You can find another person who is more comfortable working with them if they aren't.

What is estate planning?

Estate planning is the process of creating an estate plan that includes documents like wills, trusts and powers of attorney. The purpose of these documents is to ensure that you have control over your assets after you are gone.

Why it is important that you manage your wealth

The first step toward financial freedom is to take control of your money. Understanding your money's worth, its cost, and where it goes is the first step to financial freedom.

You also need to know if you are saving enough for retirement, paying debts, and building an emergency fund.

You could end up spending all of your savings on unexpected expenses like car repairs and medical bills.

What Are Some Examples of Different Investment Types That Can be Used To Build Wealth

There are many investments available for wealth building. Here are some examples:

-

Stocks & Bonds

-

Mutual Funds

-

Real Estate

-

Gold

-

Other Assets

Each has its own advantages and disadvantages. Stocks or bonds are relatively easy to understand and control. However, they tend to fluctuate in value over time and require active management. Real estate, on the other hand tends to retain its value better that other assets like gold or mutual funds.

Finding the right investment for you is key. The key to choosing the right investment is knowing your risk tolerance, how much income you require, and what your investment objectives are.

Once you have determined the type of asset you would prefer to invest, you can start talking to a wealth manager and financial planner about selecting the best one.

How to Begin Your Search for A Wealth Management Service

You should look for a service that can manage wealth.

-

Has a proven track record

-

Is based locally

-

Consultations are free

-

Supports you on an ongoing basis

-

A clear fee structure

-

Excellent reputation

-

It is easy and simple to contact

-

You can contact us 24/7

-

A variety of products are available

-

Low fees

-

Do not charge hidden fees

-

Doesn't require large upfront deposits

-

Have a plan for your finances

-

Is transparent in how you manage your money

-

Makes it easy for you to ask questions

-

Have a good understanding of your current situation

-

Understands your goals and objectives

-

Is available to work with your regularly

-

Works within your financial budget

-

Good knowledge of the local markets

-

Is willing to provide advice on how to make changes to your portfolio

-

Will you be able to set realistic expectations

Statistics

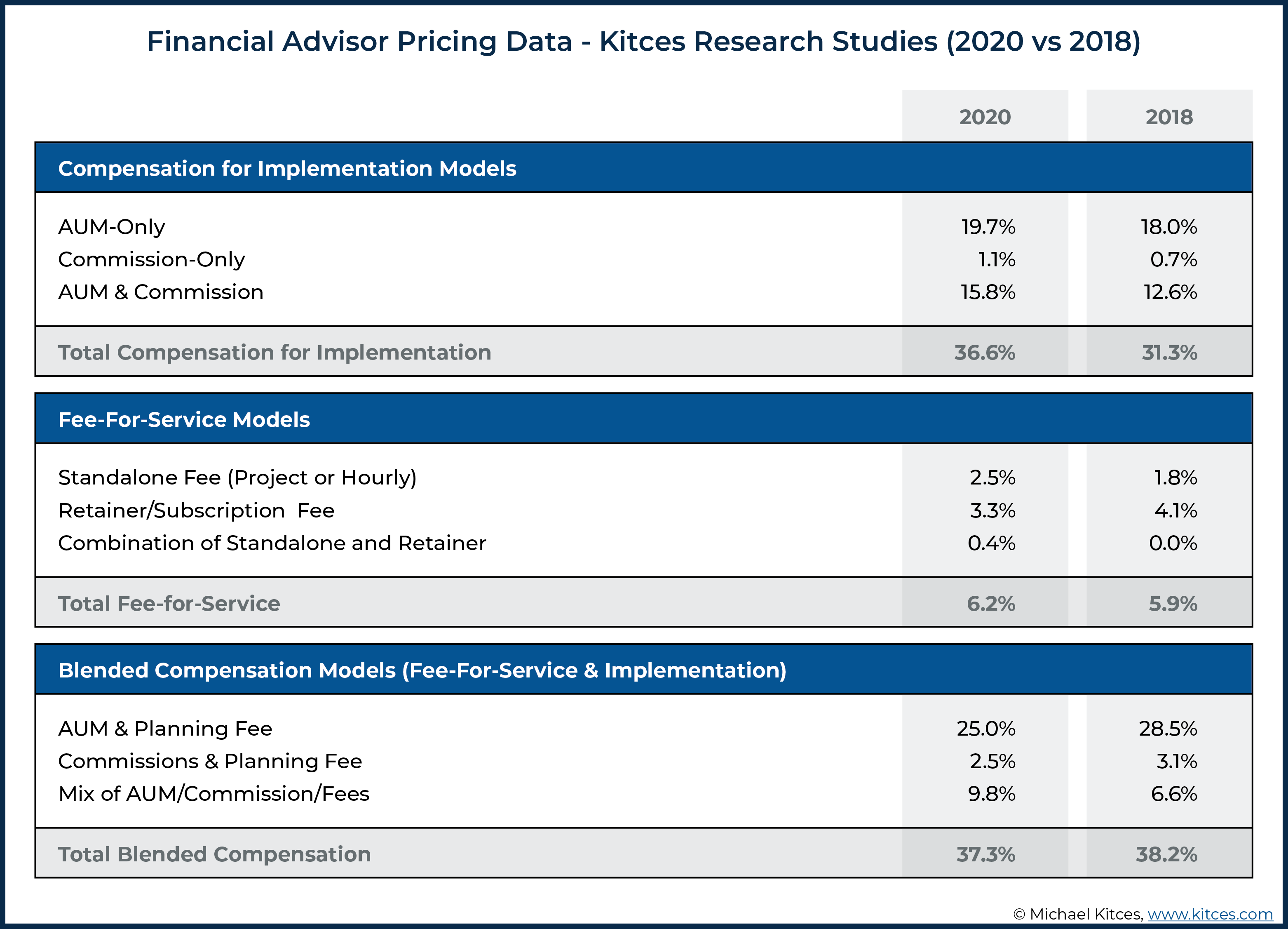

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- These rates generally reside somewhere around 1% of AUM annually, though rates usually drop as you invest more with the firm. (yahoo.com)

External Links

How To

How to save money on salary

You must work hard to save money and not lose your salary. Follow these steps to save money on your salary

-

You should get started earlier.

-

You should cut back on unnecessary costs.

-

Online shopping sites like Flipkart, Amazon, and Flipkart should be used.

-

Do not do homework at night.

-

You should take care of your health.

-

Try to increase your income.

-

Live a frugal existence.

-

You should always learn something new.

-

You should share your knowledge.

-

Regular reading of books is important.

-

Make friends with people who are wealthy.

-

You should save money every month.

-

For rainy days, you should have money saved.

-

Your future should be planned.

-

Time is not something to be wasted.

-

Positive thoughts are important.

-

Negative thoughts are best avoided.

-

God and religion should be prioritized.

-

Maintaining good relationships with others is important.

-

You should enjoy your hobbies.

-

Self-reliance is something you should strive for.

-

You should spend less than what you earn.

-

You should keep yourself busy.

-

It is important to be patient.

-

It is important to remember that one day everything will end. It's better to be prepared.

-

You should never borrow money from banks.

-

Always try to solve problems before they happen.

-

You should strive to learn more.

-

You need to manage your money well.

-

You should be honest with everyone.