Fiduciary advisors provide objective advice to business owners in the financial industry. They might be specialists in insurance products or succession planning. Or they may provide guidance on a range of financial topics. A fiduciary adviser is an extension of the financial team of the business owners.

Investing with a fiduciary

Fiduciary advisors represent financial advisers that put their clients' best interests first. These individuals may be paid on a flat fee, a commission, or a percentage of AUM. They may charge hourly, monthly, or even quarterly fees. It is crucial to find out how they are paid if you choose to work with fiduciary advisory advisors.

A fiduciary advisor is required by law to act in the client's best interests. Broker-dealers and insurance agents don't have this obligation, which means they can recommend products that benefit their bottom line or give them a commission. These products may seem appealing on paper but they might not be the best for clients.

Fiduciary advisor fees

A fiduciary financial advisor is one who charges a fee only. These advisers must be fee-only and CFP(r)-certified. They must also be available to provide advice. Fiduciaries don't have to adhere to an asset minimum, or a long time commitment. If you need advice only, a fee-only consultant may be the best solution. Through e-learning, the Garrett Planning Network fosters community among advisors.

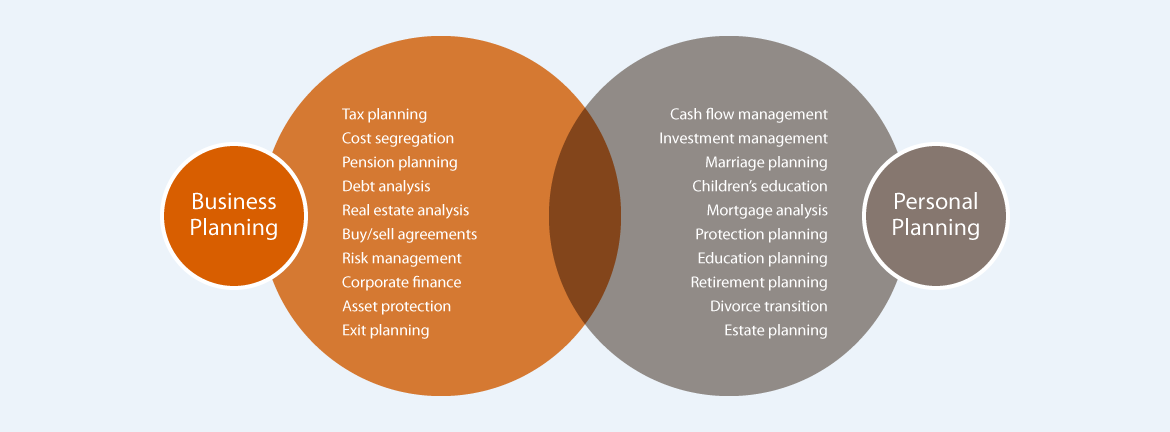

Fiduciary advisors can be paid a fee in addition to having broader responsibilities than those who are fee-only. They may perform other services as well, including estate planning and tax planning. They may also evaluate your investments to protect your assets. They can help you make larger charitable donations. These services go far beyond managing your wealth.

What is the difference between a financial advisor and a fiduciary?

It is important that you find out if your financial advisor is a fiduciary prior to choosing them. Look up the registration number of your financial advisor with Securities and Exchange Commission (SEC). The SEC maintains a database of investment advisors and their Form ADVs.

An annual Form ADV must be filed annually by investment firms. It lists the credentials, fees, and disciplinary records of investment advisors. You can also see if there has been any complaint against fiduciary investment advisors via the FINRA brokerage portal.

SEC regulations on fiduciary Standards

Over the years, the SEC rules governing fiduciary guidelines have been interpreted many ways. The SEC rules on client care are based primarily on the principles of equitable commonlaw and the duty for trust and confidance. Advisors are free to determine the scope of their fiduciary duties, but they may have different requirements than those set forth by the SEC.

While fees and compensation are not the only factor that will decide if an investment is in a client’s interest, there are many other factors. You must consider other factors such as the investment's character. The investment must be suitable for long-term goals of the client and meet investor's investment objectives. Financial advisors are not required to recommend high cost products by the SEC.

How fiduciary are robo-advisors

There are some issues with robo-advisors that investors should understand before using one. A registered advisor must act in clients' best interests regardless of whether the client is using a 401(k), personal portfolio, or other investment plan. Although robo advisors don't sell any proprietary products, they must adhere to ERISA fiduciary rules. A robo adviser offering 401(k), plan advice has to follow ERISA's fiduciary rules. While robo-advisors may not offer the same level of expertise that a human advisor can provide, most offer advice that is based on the client's financial situation and goals.

While many consumers may feel comfortable with this new type of investment service, some may feel hesitant about trusting a company with their money. It is also unclear whether a robo-adviser's investment advice is truly unbiased. In some cases, a robo-adviser may perform services that are not covered by a fiduciary standard, including recommending stocks.

FAQ

What Are Some Of The Different Types Of Investments That Can Be Used To Build Wealth?

There are several different kinds of investments available to build wealth. Here are some examples.

-

Stocks & Bonds

-

Mutual Funds

-

Real Estate

-

Gold

-

Other Assets

Each one has its pros and cons. Stocks and bonds, for example, are simple to understand and manage. However, they can fluctuate in their value over time and require active administration. However, real estate tends be more stable than mutual funds and gold.

It comes down to choosing something that is right for you. The key to choosing the right investment is knowing your risk tolerance, how much income you require, and what your investment objectives are.

Once you have made your decision on the type of asset that you wish to invest in, it is time to talk to a wealth management professional or financial planner to help you choose the right one.

What is risk management in investment management?

Risk Management refers to managing risks by assessing potential losses and taking appropriate measures to minimize those losses. It involves identifying, measuring, monitoring, and controlling risks.

Any investment strategy must incorporate risk management. The goal of risk-management is to minimize the possibility of loss and maximize the return on investment.

These are the key components of risk management

-

Identifying sources of risk

-

Monitoring and measuring the risk

-

How to control the risk

-

Manage the risk

What are some of the best strategies to create wealth?

Your most important task is to create an environment in which you can succeed. It's not a good idea to be forced to find the money. If you're not careful, you'll spend all your time looking for ways to make money instead of creating wealth.

Additionally, it is important not to get into debt. While it's tempting to borrow money to make ends meet, you need to repay the debt as soon as you can.

If you don't have enough money to cover your living expenses, you're setting yourself up for failure. And when you fail, there won't be anything left over to save for retirement.

You must make sure you have enough money to survive before you start saving money.

Statistics

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

External Links

How To

How to Beat Inflation with Investments

Inflation can be a major factor in your financial security. It has been observed that inflation is increasing steadily over the past few years. Each country's inflation rate is different. For example, India is facing a much higher inflation rate than China. This means that your savings may not be enough to pay for your future needs. You risk losing opportunities to earn additional income if you don't invest often. So, how can you combat inflation?

Investing in stocks is one way to beat inflation. Stocks are a great investment because they offer a high return of investment (ROI). These funds can be used to purchase gold, silver and real estate. However, before investing in stocks there are certain things that you need to be aware of.

First of all, you need to decide what type of stock market it is that you want. Do you prefer large-cap companies or small-cap ones? Choose accordingly. Next, learn about the nature of the stock markets you are interested in. Is it growth stocks, or value stocks that you are interested in? Make your decision. Then, consider the risks associated to the stock market you select. There are many types of stocks available in the stock markets today. Some stocks can be risky and others more secure. Choose wisely.

Get expert advice if you're planning on investing in the stock market. They will tell you whether you are making the right choice. If you are planning to invest in stock markets, diversify your portfolio. Diversifying will increase your chances of making a decent profit. If you only invest one company, you could lose everything.

If you still need assistance, you can always consult with a financial adviser. These professionals can help you with the entire process of investing in stocks. They will help ensure that you choose the right stock. You will be able to get help from them regarding when to exit, depending on what your goals are.